An Increase in Interest Rates Causes Which of the Following

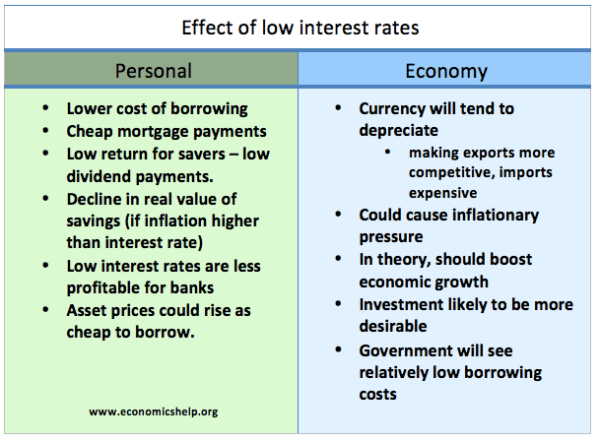

Higher interest rates have various economic effects. Changes in the price level.

Effect Of Raising Interest Rates Economics Help

What is equilibrium interest rate.

. The current market value spot exchange rate of a countrys currency can be affected by any or all of the following not necessarily in. 3 An increase in the interest rate causes A a movement up along the money demand curve. AAn increase in interest rates as the demand for money increases.

As price levels increase the demand for money increases. How Interest Rate Hikes Cause The Stock Market to Rise. First off it becomes more attractive to invest in things like CDs and Savings accounts versus an over inflated stock market.

O Two statements are correct. Both output and interest rate will decrease. See the answer See the answer done loading.

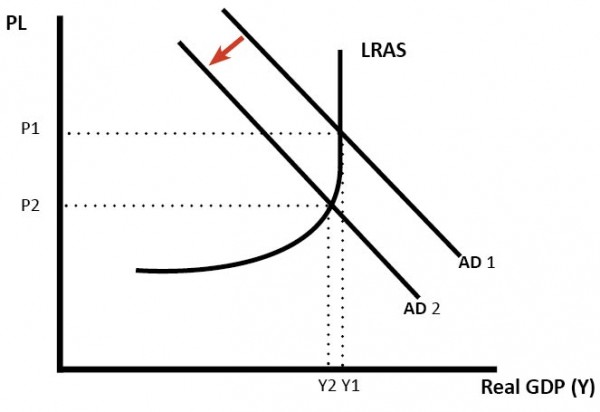

Higher interest rates tend to moderate economic growth. Given this information a reduction in the money supply A will cause investment to decrease. C the money demand curve to shift to the left.

Output will increase and interest rate falls. D A decrease in interest rates as. An increase in the interest rate causes money demand to increase.

B will cause investment to increase. There are a number of reasons why Interest Rate hikes cause the stock market to rise. An increase in taxes causes a reduction in demand for goods.

Dillon Lee March 21 2014 Macroeconomics Professor Dinterman B a movement down along the money demand curve. This occurs because lenders will. Reflective Thinking Special Feature.

For this question assume that investment spending depends only on the interest rate and no longer depends on output. Both output and interest rate will increase. A decrease in investment.

Each of the following is a factor that can shift the aggregate demand curve except. D the money demand curve to shift to the right. An increase in the interest rates will cause people to hold _ money which in turn means that the velocity of money _.

Total wealth causes a movement of interest rate along the supply curve. D increase if the economy is in a recession. A decrease in government spending.

In money markets an interest. Inflation and interest rates tend to move in the same direction because interest rates are the primary tool used by the Federal Reserve the US. Which of the following events will cause the interest rate to increase.

Increase in interest rates causes the supply curve to shift. According to the interest rate effect an increase in the price level causes people to. In the chart this position is higher on the demand curve and therefore the equilibrium interest rate is higher.

Monetary expansion causes a decrease in equilibrium rate. The Fed approved a 025 percentage point rate hike the first increase since December 2018. Increase Higher rates of anticipated inflation would tend to _ velocity.

There are may factors that cause the value of the US. D will have no effect on output. An increase in consumption.

A reduction in government spending causes a reduction in demand for goods. Dollar to increasedecrease in the foreign exchange market. An increase in the interest rate causes a reduction in the money supply.

Inflation will also affect interest rate levels. For each interest rate the LM curve illustrates the level of output where. BNo change in interest rates because changes in interest rates cause changes in investment spending.

None 5 Using the money demand and money supply model an open market purchase of Treasury securities by the Federal Reserve would cause the equilibrium interest rate to A increase. Central bank to manage inflation. An expansionary fiscal policy would most likely cause which of the following changes in output and interest rates.

A an open market sale of bonds B an increase in the reserve deposit ratio ie θ C an increase in income D all of the above Answer. Answer 1 of 5. As a general rule of thumb when the Federal Reserve cuts interest rates it causes the stock market to go up.

An increase in spending in the economy will cause which of the following changes in interest rates. What causes equilibrium interest rate. CA decrease in interest rates as the supply of money increases.

O All statements are correct. Higher interest rates increase the cost of borrowing reduce disposable income and therefore limit the growth in consumer spending. Higher interest rates tend to reduce inflationary pressures and cause an appreciation in the exchange rate.

When the Federal Reserve raises interest rates it causes the stock market to go down. Increase their money holdings which increases interest rates and decreases investment spending. Officials indicated an aggressive path ahead with rate rises coming at each of the remaining six.

Improving economic conditions causes the demand curve to shift inward. Other things being equal an increase in the interest rate causes which of the following. C may cause investment to increase or to decrease.

The higher the inflation rate the more interest rates are likely to rise.

Effect Of Raising Interest Rates Economics Help

Comments

Post a Comment